Founder’s Note: “After nearly a decade of daily operations in DeFi—managing both personal and third-party capital—I decided to focus on thoroughly analyzing each transaction from a risk management perspective, with the primary goal of protecting the capital of my trusted friends and, above all, to be able to sleep peacefully at night. My professional background as an executive at the Swiss multinational SGS for over 20 years, allowed me to apply humble knowledge and tools to conduct an in-depth study, the key findings of which I share here in the hope that they may serve finance professionals.

In the end, there is also here an undeniable truth that makes some of our peers in the traditional sector uncomfortable: critical risk disappears when you truly master what you’re doing, not because risk isn’t lurking, but because you set the pace and ensure that every step is firmly grounded. As for moderate and low risks, they depend entirely on the quality of the processes your organization is truly able to adopt — which must be dynamic and adaptable to each new situation, like a sailboat adjusting to changes in the wind direction.

As conclusion, the concept is simple but the implementation is not. The good news is that industries reinvented through blockchain tech enjoy two unprecedented competitive advantages in human history as risk reducer: immutable transparency and the drastic reduction of third-party guarantors enabled by consensus mechanisms.

I am deeply grateful to the YAM & SECUREUM community for its valuable contributions in identifying industry system vulnerabilities, sharing post-mortem analyses, and the implementation of safe practices.”

MG – CEO, OWL Capital

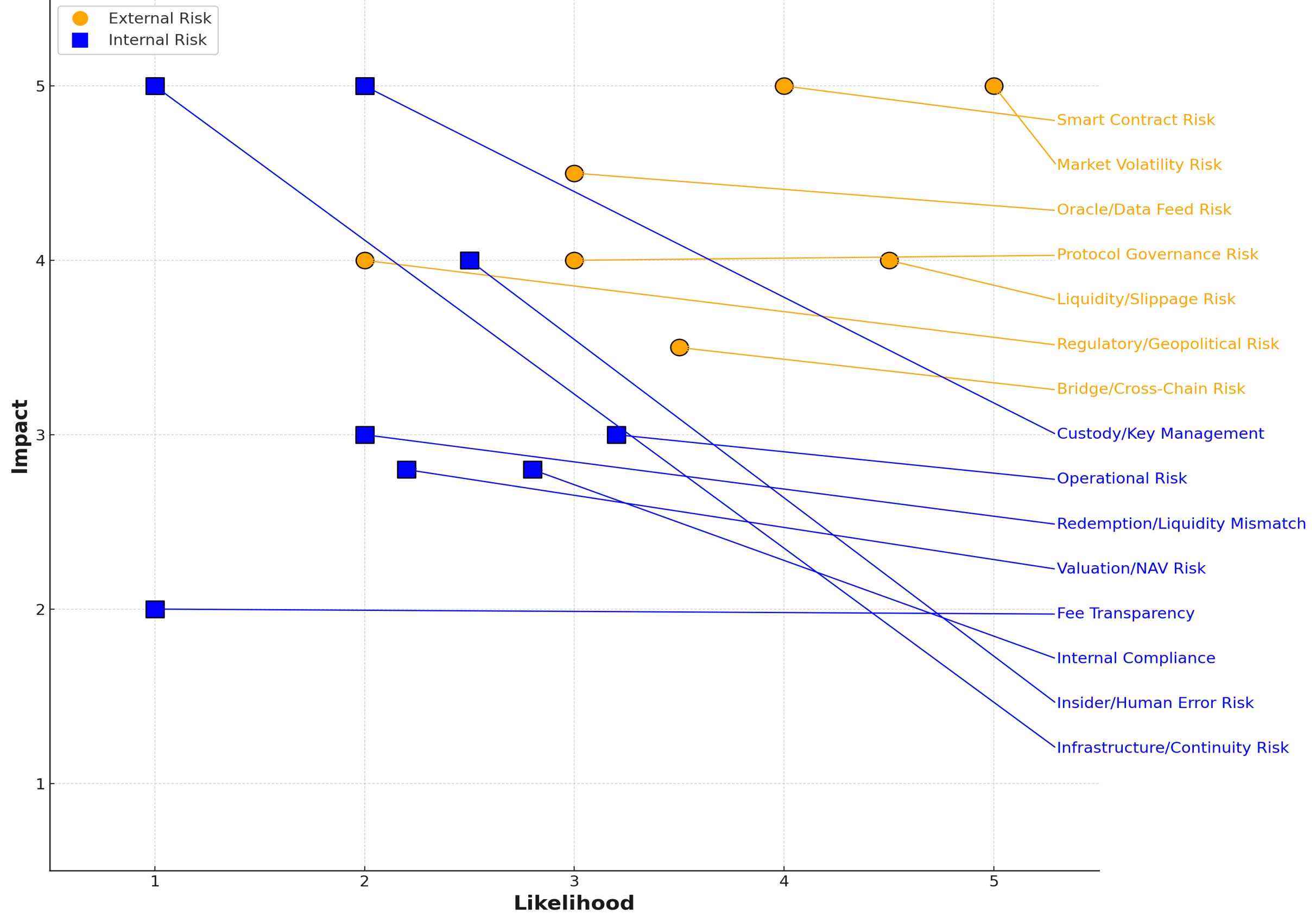

In the innovative evolving crypto and DeFi ecosystem, managing risk is not an afterthought—it's a central element of capital preservation and long-term performance. Our firm applies a comprehensive risk management framework segregated into 3 risk clusters REGULATORY, OPERATIONAL and FINANCIAL, which distinguishes between EXTERNAL (market/institution-related) and INTERNAL (company-level/operational) risks.

Quick summary of risks derived from the underlying counterparties, 3rd parties, markets, or infrastructure we interact with.

Quick summery of risks that arise from the fund’s own structure, custody, processes, and governance.